Preamble

(yep, one of those)

The purpose of this blog post is to spark a meaningful discussion and propose an innovative approach to creating and sustaining affordable housing in Australia. The aim is to offer a long-term solution that fosters intergenerational collaboration and investment.

While we’ve previously critiqued models like Build-to-Rent for being short-sighted responses to systemic problems, this post shifts the narrative toward constructive alternatives. Instead of perpetuating the status quo—where predictable and subpar outcomes reign—we present a bold new path forward.

Our solution is different by design.

The housing crisis demands a fundamental redefinition of how we view land development and ownership. Centralising land control in the hands of private companies has proven insufficient. Public land, owned by the taxpayers, must be harnessed for the collective good.

Public-private partnerships, though often understated, offer the accountability and innovation needed to bridge the gap. While this may not be a glamorous solution, it harks back to the quality and ambition of post-war social housing—developments that far surpass today’s project-builder offerings.

Australia is at a pivotal moment. Housing, unlike other sectors, is a reliable engine for economic and social stability. As a highly desirable migration destination, Australia must embrace housing as a mechanism for growth, sustainability, and opportunity. By tying housing to local manufacturing and service industries, we can reverse the offshoring trends of recent decades.

This is about more than just homes; it’s about rekindling our values, fostering pride in our communities, and building a future where housing affordability and quality are not mutually exclusive.

Amid the uncertainty of today, we have a unique chance to pivot, to chart a new course. This vision won’t be without its challenges, but the potential rewards—a cohesive, productive, and equitable society—are worth the effort. By giving people hope, purpose, and the prospect of owning a home, we create a nation where everyone has a stake in its prosperity. Let’s embrace the opportunity to do things differently, together.

+

"There are profound implications for income disparity. Those who do not own property are the new underclass. According to the ABS, average weekly housing costs are $493 for owners with a mortgage; $54 for owners without a mortgage; and $379 for renters."

- Source

Why Australia Needs a New Housing Solution

Australia’s housing prices has left many aspiring homeowners locked out of the market. With property prices surging far beyond the reach of average income earners and generational wealth disparities widening, the dream of homeownership has become elusive for many.

Traditional housing models have failed to address these challenges, leaving first-home buyers burdened by skyrocketing costs while Boomers often struggle to secure low-risk, meaningful investments for their equity.

The Boomer Bonds Economic Model is our solution to the mess that is Australian Housing. By leveraging a new innovative financial structure and incorporation community-building/driven principles, this model aligns the interests of Boomers, governments, and propsective homeowners.

Through the integration of Community Land Trusts (CLTs) and Real Estate Backed Securities (REBS), Boomer Bonds provide a sustainable and scalable framework for creating affordable housing.

Statistics from a recent survey by The Australia Institute underline the urgency:

- 36% of Australians want property current prices to decrease.

- 33% want property prices to increase.

- 60% of renters want prices to fall, while 59% of investment property owners want prices to rise.

The purpose of this blog is to present a comprehensive, innovative housing model that benefits both generations:

- Boomers secure reliable returns on their property equity.

- Younger Australians gain access to affordable, sustainable housing solutions.

An asset-backed security is a security whose income payments, and hence value, are derived from and collateralised by a specified pool of underlying assets. The pool of assets is typically a group of small and illiquid assets which are unable to be sold individually.

Pooling the assets into financial instruments allows them to be sold to general investors, a process called secularisation, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. SOURCE

The Current Housing Market and Its Challenges

The Australian housing market is a battleground of competing interests:

- 36% of Australians want property prices to decrease.

- 33% want prices to rise.

- 60% of renters advocate for falling prices, reflecting their struggle to enter the market.

- Conversely, 59% of investment property owners prefer rising property values to protect their investments.

These statistics reveal a generational and financial divide:

- Boomers: Many depend on rising property values to sustain their retirement plans, with property equity serving as their primary investment vehicle.

- Millennials and Gen Z: Locked out of home ownership due to a disproportionate income-to-property value ratio, younger generations face a daunting financial landscape.

Cognitive Dissonance in the Housing Market

Australia’s housing market is a clear example of cognitive dissonance:

- On one hand, Boomers seek to protect and grow the value of their property investments.

- On the other, younger Australians—burdened by stagnant wages and rising living costs—cannot afford to enter the market.

What Are Boomer Bonds?

Boomer Bonds are an innovative financial instrument we suggest CAN address the housing crisis by aligning the interests of generations. These bonds create a win-win scenario by providing Boomers with secure, low-risk investments while enabling younger Australians to access affordable housing.

Boomer Bonds are a type of investment vehicle backed by the equity in Boomers’ real estate portfolios. These bonds fund affordable housing developments through Community Land Trusts (CLTs) and modular home construction. By pooling equity from Boomers, the bonds create a sustainable funding source that benefits all stakeholders.

How the Model Aligns Interests

- For Boomers:

- Bonds are secured against the CLT’s land, providing a stable and low-risk investment.

- Investors receive a fixed annual yield of 6.5%, supplemented by profit-sharing mechanisms.

- For Younger Australians:

- Modular homes are constructed on CLT-owned land, reducing the upfront costs of home ownership.

- Buyers pay only for the value of the dwelling, not the land, making homes significantly more affordable.

Moveable Chattel Homes on Leased Land

A distinctive feature of our Boomer Bonds model is the introduction of moveable chattel homes:

- Homes are treated as personal property rather than real estate, making ownership more accessible.

- The land remains under CLT ownership, ensuring long-term affordability and community control.

- Buyers can sell or transfer their homes, retaining 80% of resale profits while 20% supports the CLT’s operations.

The Community Land Trust Model

Community Land Trusts (CLTs) are a cornerstone of the Boomer Bonds model, offering a sustainable and equitable approach to land ownership. In this model, the land is held collectively, ensuring it remains a shared resource for the community rather than a speculative asset.

Key Features of CLTs

- Permanent Affordability:

- By separating the cost of the land from the cost of the home, CLTs keep housing affordable over the long term.

- Community-Centric Development:

- Decisions about the use and management of the land are made collectively, ensuring developments meet the community’s needs.

- Shared Equity Model:

- Homeowners retain 80% of the profits from resale, while 20% is reinvested into the CLT to fund community development and services (improve community value).

Environmental and Social Value

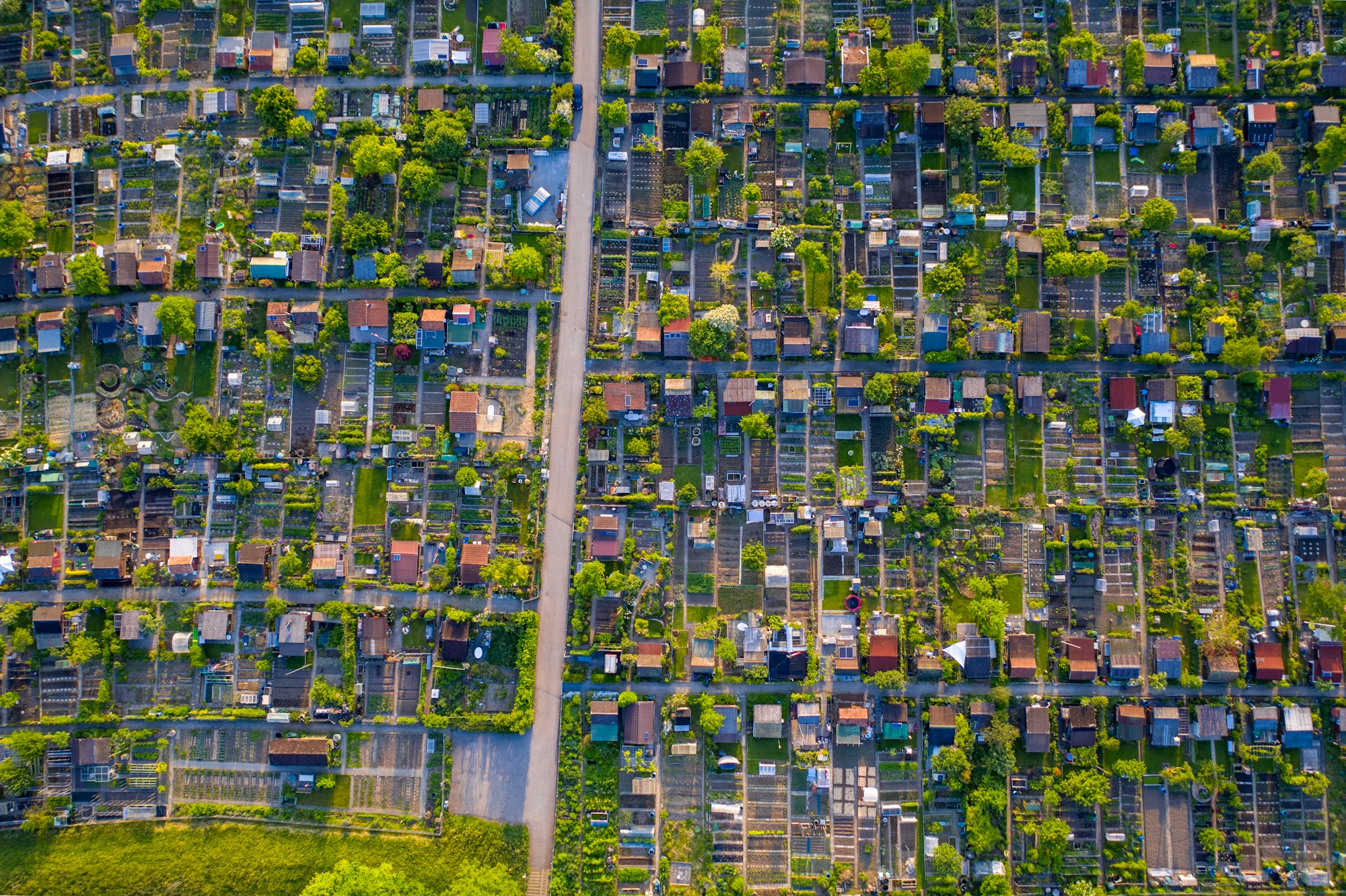

- Green Spaces: CLTs often integrate parks and communal areas, community gardens (fruit and vegetable/produce) and landscape, enhancing livability.

- Sustainability: Modular homes on CLT land promote eco-friendly construction and energy efficiency.

The CLT model ensures that land remains a community asset, creating a foundation for sustainable growth and affordable housing.

How Boomer Bonds Work

The Boomer Bonds model operates through a structured funding and ownership framework that ensures affordability for home buyers and profitability for investors.

Funding Mechanism

- Bond Issuance:

- Boomers purchase bonds secured against the CLT land. The funds raised from these bonds are used to construct modular homes and develop infrastructure.

- Bonds offer a fixed annual yield of 6.5%, ensuring predictable returns for investors.

- Government Backing:

- To mitigate risk, the state government provides a first-loss guarantee on 10% of the bond value, enhancing investor confidence.

Ownership Model

- Affordable Home ownership:

- Home buyers pay only for the value of the dwelling, not the land, significantly lowering entry costs.

- Payments are structured over 15–20 years, making monthly repayments manageable.

- Resale and Equity Growth:

- Upon resale, buyers retain 80% of the profits, encouraging investment in home improvements and sustainability upgrades.

- The remaining 20% of resale profits is reinvested into the CLT to fund future housing developments.

Revenue Model

- For Bondholders:

- Investors receive regular interest payments funded through lease and resale revenues.

- Additional returns come from a profit-sharing arrangement tied to resale transactions.

- For CLTs:

- Revenue from leases and resale profits supports operational sustainability and future projects.

The Boomer Bonds model is a self-sustaining system that balances affordability for homebuyers with secure, attractive returns for investors.

Benefits for Stakeholders

For Boomers

- Secure Investments: Boomer Bonds offer a low-risk investment option backed by land assets and a fixed annual yield of 6.5%. This makes investing easier for Boomers given its State backed and secured over property.

- Community Legacy: By investing in housing affordability, Boomers contribute to the creation of sustainable communities, leaving a positive impact for future generations.

- Profit Sharing: Additional returns from resale profits enhance overall investment attractiveness.

- Liquidity: through REBS (see below)

- No Attacking Negative Gearing or Superannuation: This model incentivises and rewards Boomers for their hard work and the equity they’ve built. Their investment is beneficial for them, stable, and directly contributes to making affordable housing accessible to others. Rather than framing the conversation as taking from one group to give to another, this model focuses on positivity and collaboration. I dont mean that bullshit, head in the sand positivity either. Just practical, lets not talk doom and gloom when there is a positive way to make this work.

For First-Home Buyers

- Affordable Entry Point: Modular homes eliminate the high upfront cost of land, reducing financial barriers to home ownership.

- Path to Ownership: A lease-to-own model enables buyers to gradually acquire their homes over time. Unlike BTR housing models money paid goes towards ownership, not just usage/habitation.

- Equity Growth: Buyers retain 80% of resale profits, creating opportunities for wealth accumulation and financial stability.

For Communities

- Improved Livability: CLTs integrate green spaces, community facilities, and sustainable housing, enhancing the overall quality of life. These communities are master-planned to maximise livability and foster a strong sense of community. Unlike traditional housing developments, homes are sized and oriented for energy efficiency and constructed using passive building principles. A well-designed building envelope further reduces ongoing running costs.

- Shared Services (see below): Community Land Trusts (CLTs) can achieve unparalleled self-sufficiency by managing shared services and infrastructure independently of external providers. This autonomy supports the core principle of communities managing themselves effectively, ensuring efficiency and alignment with community values.

- Reduced Housing Inequality: By prioritising affordability, Boomer Bonds address systemic inequities in the housing market.

- Self-Sustaining Development: Revenue reinvested into CLTs funds future projects, ensuring ongoing community growth.

More on Shared Services

Self-Sustaining Infrastructure

- Renewable Energy Networks: CLTs operate their own solar power generation systems with integrated inverters, DC connected equipment and microgrids, providing reliable and sustainable energy directly to residents.

- Waste Management: Onsite waste treatment systems, such as composting and recycling centres, allow communities to handle waste independently, reducing reliance on external services, reducing community costs (cost of living).

- Water Systems: Rainwater harvesting and onsite treatment systems ensure a consistent water supply while promoting good water management practices.

- Off-Grid Independence: By designing developments to be entirely off-grid, CLTs reduce dependency on traditional infrastructure and eliminate vulnerabilities associated with large-scale utility disruptions.

Local Employment and Community Management

CLTs contract or directly employ residents to manage these essential services, creating jobs and keeping economic benefits within the community. Residents take ownership of their environment, fostering accountability and a shared sense of purpose.

Freedom from Corporate Oversight

Unlike traditional Build-to-Rent (BTR) models, which are often managed by large corporate entities, CLTs empower residents to self-govern. This approach eliminates excessive management fees, prioritises the community's needs, and ensures that the people who live in the community retain control over its operations.

For Governments

- Risk Mitigation: A first-loss guarantee incentivises private investment while maintaining fiscal responsibility.

- Economic Growth: Affordable housing projects stimulate local economies through construction, infrastructure, and increased home ownership rates.

- Policy Leadership: Supporting Boomer Bonds positions governments as innovators in addressing housing challenges.

The Role of Government

State governments play an important role in the success of the Boomer Bonds model, acting as both facilitators and enablers of affordable housing developments. Their involvement ensures the framework’s financial viability and societal impact.

Providing Land for CLTs

- Access to Land: Governments allocate public land to Community Land Trusts (CLTs) at concessional rates, reducing development costs and preserving affordability.

- Preventing Market Manipulation: By holding land in trust, the state safeguards against speculative practices by large developers, ensuring fair competition and community-driven growth.

Risk Mitigation

- First-Loss Guarantee: To encourage private investment, the state provides a guarantee on 10% of the bond value. This reduces perceived risks for investors, making Boomer Bonds an attractive option for Boomers seeking secure returns.

Policy Frameworks and Incentives

- Legislative Support: Governments establish regulations that enable the lease-to-own model and protect the interests of both bondholders and homebuyers.

- Tax Incentives: Offering tax breaks to bondholders and CLTs can further incentivise participation and reduce operational costs.

- Infrastructure Development: Governments invest in essential infrastructure like roads, utilities, and public transport to enhance the livability of CLT communities.

Social and Economic Benefits

- Addressing Housing Inequality: Government involvement ensures the equitable distribution of resources, making homeownership accessible to a broader demographic.

- Stimulating Local Economies: Affordable housing developments generate jobs in construction, infrastructure, and related industries, boosting regional economic growth.

- Sustainability Leadership: By supporting eco-friendly modular construction, governments set an example in promoting sustainable urban planning.

State governments’ proactive engagement ensures the Boomer Bonds model not only meets its affordability goals but also contributes to long-term societal and economic benefits.

The Role of Real Estate Backed Securities (REBS) and Community Growth

Real Estate Backed Securities (REBS): A Flexible Investment Option

One of the standout features of the Boomer Bonds model is its reliance on Real Estate Backed Securities (REBS), which offer Boomers and other investors a flexible and tradeable investment instrument. By securitising the bond fund, investors can:

- Achieve Liquidity: REBS can be traded in secondary markets, allowing investors to sell their holdings to others at any time. This provides an opportunity to realise capital gains from increased value driven by the success of the development.

- Benefit from Increased Value: As the desirability of the community grows and resale values of dwellings rise, the value of REBS can appreciate. This offers investors the dual advantage of stable annual yields and the potential for capital appreciation.

Instilling a Culture of Continuous Improvement in CLTs

At the core of the Boomer Bonds model is the principle that Community Land Trusts (CLTs) must actively focus on fostering vibrant, self-sustaining, and desirable communities. This is achieved through:

- Ongoing Development Enhancements:

- Regularly updating infrastructure, green spaces, and communal facilities to improve livability.

- Promoting eco-friendly and sustainable building practices to enhance the community’s environmental footprint.

- Community Cohesion and Self-Governance:

- Encouraging a sense of ownership and pride among residents by supporting self-governance models.

- Providing tools and resources for communities to manage themselves effectively, fostering harmony and cooperation.

- Building Desirability:

- By creating a cohesive, friendly, and well-managed environment, CLTs make their developments more appealing to outsiders.

- Increased demand from prospective buyers drives up the resale value of dwellings, creating upward pressure on prices.

How REBS Value Can Increase

The appreciation in dwelling sales prices reflects the growing desirability of the community, directly benefiting REBS investors. As communities mature and attract higher resale premiums, the underlying assets backing the REBS gain value. This creates:

- Stronger Secondary Market Demand: Higher dwelling values make the REBS more attractive to other investors looking for growth opportunities.

- Enhanced Liquidity: Investors wishing to exit their positions can do so profitably by selling their REBS at a premium, ensuring they realise gains from both the yield and the asset’s appreciation.

Government-Backed Insurance: A New Opportunity

Building on the Boomer Bonds framework, the government could establish its own insurance industry to further support and safeguard the model. By offering policies specifically tied to Boomer Bonds and CLT developments, the government ensures comprehensive coverage while generating additional revenue streams.

- Risk Coverage for Investors:

- The government-backed insurance could offer coverage against risks such as market fluctuations, infrastructure failures, or natural disasters impacting CLT developments.

- This insurance adds an additional layer of security for bondholders, increasing confidence and participation in the Boomer Bonds scheme.

- Operational Insurance for CLTs:

- CLTs could access affordable insurance for community-owned utilities, shared services, and infrastructure.

- This reduces operational risks while keeping insurance costs within the public sector, avoiding the need for expensive private alternatives.

- Revenue Generation and Liquidity:

- Premiums collected from policies contribute to government revenue, which can be reinvested into housing, infrastructure, or further support for CLTs.

- The government’s involvement ensures competitive pricing and eliminates profit offshoring typically associated with private insurers.

- Integration with REBS and Investment Incentives:

- Insurance tied to Real Estate Backed Securities (REBS) could protect investors against specific risks, making the bonds even more attractive.

- By stabilising the investment environment, this mechanism enhances liquidity, as insured REBS are likely to be in higher demand in secondary markets.

- Long-Term Benefits:

- Establishing a government-backed insurance arm reinforces the sustainability of the Boomer Bonds model, creating a self-sustaining ecosystem where risks are mitigated, and revenues are reinvested into national development.

- This initiative aligns with the broader vision of using housing as a catalyst to stimulate Australia’s economy, reduce inequality, and promote sustainable growth.

Community Land Trusts as Self-Governing Entities

A key feature of the Boomer Bonds model is the empowerment of Community Land Trusts (CLTs) to operate as their own form of local council. This decentralised governance model ensures that community values remain central to decision-making and that management is tailored to the unique needs and aspirations of the residents.

Self-Governance Based on Community Values

- Localised Decision-Making:

- CLTs act as independent governing bodies, free from the micromanagement of larger state or regional councils.

- Decisions regarding infrastructure, community rules, and development priorities are made by and for the residents.

- Value-Driven Management:

- Each CLT establishes its own guiding principles and values, which form the foundation for governance.

- These values could include sustainability, inclusivity, and fostering a respectful living environment.

- Accountability to Residents:

- Residents have a direct say in how their community is run through regular meetings, voting on key issues, and participation in committees. No management votes or board with higher weighted voting, just a simple majority vote wins approach.

- This hands-on approach ensures that governance reflects the collective interests of the community.

Advantages of Self-Governance

- Tailored Solutions: Local residents understand their community’s needs better than distant authorities, leading to more effective and relevant decision-making.

- Community Cohesion: Self-governance fosters a sense of ownership and pride, encouraging residents to work together to improve their community.

- Autonomy and Freedom: By being independent of larger council authorities, CLTs can avoid bureaucratic delays and implement changes more swiftly.

A Simple Rule: If You Don’t Agree, Don’t Move In

One of the most empowering aspects of self-governance is that communities can define their own rules and values. Prospective residents must accept these principles when choosing to join the community. This creates:

- A shared sense of purpose and alignment among residents.

- Clear expectations for newcomers, ensuring harmony and reducing conflicts.

- A model where those who don’t align with the community’s values simply opt not to move in.

- Communities will naturally differ from one another based on the unique values, priorities, and demographics of their residents. This diversity is a strength, allowing prospective owners to choose a community that aligns with their own principles and lifestyle.

By placing the management of the community in the hands of its residents, CLTs ensure that governance is not only effective but also deeply rooted in the collective identity and aspirations of the people who live there.

Government-Run Utilities and Services for CLTs

To further support Community Land Trusts (CLTs) and generate revenue, the government can establish state-owned utilities and service providers tailored to the needs of these communities. By creating a publicly owned solar power generation company to supply energy to CLTs, the government ensures affordable and sustainable energy solutions while retaining profits within the public sector.

This approach can be expanded to include publicly owned water supply companies, internet providers, maintenance services, and waste management companies.

State-operated utilities not only provide streamlined services to CLTs but also create significant employment opportunities, fostering economic growth and stability. By integrating these services into the CLT framework, the government positions itself as a key stakeholder, ensuring consistent quality while benefiting from additional revenue streams. This model aligns public interest with economic sustainability, making it a cornerstone of community-focused development.

This is directly from the QIC - Queensland Investment Coporation website SOURCE:

We were established in 1991 to maximise risk-adjusted investment returns for our owner and foundational client, the Queensland Government, and other like-minded clients. We have benefited from the stability offered by government ownership — delivering higher standards of accountability in investment decision-making. In return, this has provided us the advantage of long-term thinking.

Why are we not setting up State based Development corporations with the same mandate as QIC

Investing in Australian Manufacturing and Services through Housing

The future of Australia lies in reinvigorating our manufacturing and service industries to strengthen the nation’s self-reliance and economic resilience. Rather than outsourcing critical sectors, Australia has an opportunity to tie investments in these industries directly to the supply of housing—a market with insatiable demand.

By aligning housing development with locally produced materials, state-run utilities, and Australian-based service providers, the country can create a sustainable ecosystem that supports both economic growth and community development. Embracing this approach ensures that the benefits of housing projects remain within the nation, fostering job creation, skills development, and national pride.

Outsourcing these opportunities dilutes the economic potential and weakens Australia's ability to secure its future. Instead, embracing local manufacturing and services as a cornerstone of housing development presents a clear pathway to long-term prosperity.

Ensuring Accountability in Public and Private Partnerships

A core tenet of this model is the emphasis on public and private partnerships to drive housing and economic development. However, for these partnerships to succeed, it must be a fundamental condition that private partners retain their profits within Australia. This means ensuring that profits are not offshored or redirected through foreign investor funds, trusts, or companies domiciled in low-tax jurisdictions.

Private partners must pay their fair share of taxes, reinvest profits into housing and manufacturing operations, and prioritise employing Australians. Housing development should not only address demand but also act as a mechanism to re-stimulate Australia’s manufacturing sector, much of which has been previously offshored or is currently at risk due to the practices of large project builders.

By anchoring profits and operations within Australia, this model supports sustainable growth, strengthens the local economy, and ensures that the benefits of development are widely shared across the nation.

Financial Feasibility and Use Cases

By leveraging existing property equity of Boomers and creating affordable housing through Community Land Trusts (CLTs), this model ensures returns for investors (Boomers) and accessibility for homebuyers (everyone else not a boomer 😄). Here, we break down the numbers and showcase how the model works in practice.

Example: A Boomer Bond Investment

- Investment Amount:

- A Boomer invests $250,000 in Boomer Bonds.

- Fixed Annual Yield:

- With a 6.5% annual return, the investor earns $16,250 per year in interest payments.

- Profit Sharing:

- Bondholders receive 10% of resale profits. For instance, if 100 modular homes are resold within 10 years at an average profit of $150,000 each, the bondholder’s share is:

- Total resale profit: $15,000,000

- Bondholder share: 10% = $1,500,000 over 10 years, or $150,000 annually across all investors.

- Bondholders receive 10% of resale profits. For instance, if 100 modular homes are resold within 10 years at an average profit of $150,000 each, the bondholder’s share is:

- Total Returns:

- Combining fixed yields and profit sharing, the effective annual return is approximately 6.93%.

Cost Savings for Homebuyers

- Modular Home Price:

- Modular homes are priced at $350,000, significantly lower than traditional housing due to the exclusion of land costs.

- Lease Payments:

- Buyers lease-to-own the modular homes, paying $1,800 per month—about 25% below typical market rents. Over 15 years, total payments are $324,000.

- Ownership Transition:

- At the end of the lease period, the buyer fully owns the home and has built equity, retaining 80% of any resale profit of the house component (land is owned by the CLT).

CLT Revenue and Sustainability

- Resale Profit Sharing:

- CLTs retain 20% of house resale profits to fund future developments. Using the example above, CLTs would earn $3,000,000 from 100 resales over 10 years.

- Lease Income:

- With 200 homes, lease payments generate $4,320,000 annually, funding operational costs and bondholder yields.

Scaling the Model

- For every $35,000,000 in bond investments, approximately 200 modular homes can be developed, creating a scalable solution to address housing shortages.

- The model can be expanded across regions by replicating the CLT framework and leveraging public land allocations.

Addressing Potential Criticisms

While the Boomer Bonds model offers a promising solution to Australia’s housing crisis, it is important to address potential concerns and challenges to ensure its feasibility and fairness.

1. Security of Boomer Bonds as Investments

- Concern: Investors may question the security and reliability of Boomer Bonds as an investment vehicle.

- Solution:

- Bonds are backed by land assets held in trust, providing tangible security.

- The state government’s first-loss guarantee further mitigates investment risks.

- Fixed annual yields and additional profit-sharing mechanisms ensure consistent and attractive returns.

2. Resistance from Developers

- Concern: Large property developers might resist the widespread adoption of CLTs, viewing them as competition to traditional housing models.

- Solution:

- Government support and legislative frameworks can protect CLTs from anti-competitive practices.

- Emphasising community-driven development aligns the model with public interests, garnering broader support.

3. Legal and Logistical Challenges of Movable Chattel Homes

- Concern: The concept of treating homes as movable chattel may face regulatory and legal hurdles.

- Solution:

- Clear legislative definitions and protections can formalise the status of chattel homes, ensuring compliance with property and financial regulations.

- Collaboration with local councils and planning authorities ensures logistical feasibility.

4. Perception of Reduced Land Ownership

- Concern: Some home buyers may be wary of not owning the land their homes occupy.

- Solution:

- Education campaigns can highlight the benefits of the CLT model, such as reduced upfront costs and long-term affordability.

- Emphasising the buyer’s ability to build equity and profit from home resale addresses ownership concerns.

5. Sustainability of Revenue Streams

Concern: Critics may question the long-term sustainability of the revenue streams that fund bondholder returns and CLT operations.

- Solution:

- Revenue from lease payments and resale profit sharing creates a self-sustaining financial ecosystem.

- Regular audits and transparent financial reporting ensure accountability and adaptability to market changes.

Conclusion: Why Boomer Bonds Are the Future

The Boomer Bonds Economic Model offers a different yet practical approach to addressing Australia’s housing affordability crisis. By aligning the interests of Boomers, first-home buyers, communities, and governments, this model creates a balanced, sustainable system that benefits all stakeholders.

Generational Harmony Through Shared Prosperity

Boomer Bonds bridge the generational divide in housing by:

- Providing Boomers with secure, high-yield investments that leverage their property equity.

- Enabling younger Australians to access affordable housing and build equity without the financial strain of traditional property purchases.

A Blueprint for Sustainable Communities

Through the integration of Community Land Trusts (CLTs), the model ensures:

- Long-term housing affordability by decoupling land ownership from home ownership.

- Community-driven development that prioritises environmental and social value.

- Self-sustaining funding mechanisms that support future housing projects.

Economic and Social Impact

- For Governments: Stimulates local economies, reduces housing inequality, and demonstrates leadership in sustainable urban development.

- For Communities: Enhances livability through thoughtful planning and equitable access to housing.

- For Investors: Delivers attractive, reliable returns while contributing to a greater social good.

The affordability of housing demands bold, innovative solutions that challenge traditional paradigms. Boomer Bonds represent not just a financial model, but a movement toward equity, sustainability, and shared prosperity.

By investing in Boomer Bonds, we can redefine homeownership, strengthen communities, and build a future where housing is a right, not a privilege.

This is about sparking dialogue and building momentum. Often, the easiest solution is chosen for immediate results, but it is rarely the best one. Long-term challenges require thoughtful and innovative approaches, like the one proposed here.

From firsthand conversations, it’s clear there are many investors ready to back modular manufacturing and housing initiatives like this. However, the primary barrier to commitment is the need for confirmation of sales contracts. Investors need assurance that their contributions are secure, worthwhile, and capable of delivering acceptable returns. This isn’t about speculative gains or unrealistic promises—there’s no talk of “crypto/lambo” returns here. Instead, it’s about reliable, measured risk-to-reward ratios over time.

Example of Boomer Bonds: How It Works and Benefits Everyone

Boomer Bonds: A Model to Address Housing Affordability

The housing affordability crisis in Australia has reached a critical juncture. With skyrocketing property prices and generational inequity, the need for innovative solutions has never been greater. Enter the Boomer Bonds Economic Model: a unique approach to creating affordable housing that aligns financial incentives for Boomers, first-home buyers, governments, and communities. In this model we are not doing away with negative gearing.

This model integrates community land trusts (CLTs) with Real Estate Backed Securities (REBS) to fund developments, ensuring sustainability, affordability, and attractive returns for investors. Here’s how it works and why it matters.

How Does the Boomer Bonds Model Work?

1. Land Held in a Community Land Trust (CLT)

At the heart of the model is the Community Land Trust (CLT). The state government provides land—valued at $20,000,000 for 16 hectares (approximately $1,250,000 per hectare)—to the CLT for every 200 houses (approx 800m2 land area per dwelling) - Yep, not your sardine sized lots in our CLT thank you very much - stick your small lot code and (ahem, VIC looking at you - revised small lot code - lets call it the lunchbox lot code).

This ensures:

- Long-term affordability: Land ownership remains communal, preventing speculative price increases.

- Reinvestment: Profits generated through leases and resale shares are reinvested into the community development and community services.

- Community control: The CLT prioritises housing affordability and sustainability over profit motives.

2. Funding Development Through Boomer Bonds

- Bond Issuance: 140 Boomers invest $250,000 each, creating a bond fund of $35,000,000. These bonds are structured as Real Estate Backed Securities (REBS), providing liquidity and tradeability.

- Development Costs:

- Modular home construction: $70,000,000 (200 homes at $350,000 each).

- Site infrastructure: $13,000,000 (roads, utilities, and drainage).

- Total: $103,000,000 (including land).

- Investor Returns: Bondholders receive a guaranteed 6.5% annual yield (paid from project revenues) and a 10% share of resale profits from modular homes. Combined, this offers an effective annual return of 6.93%.

3. Revenue Streams for Bondholders

- Fixed Yield: Bondholders receive $2,275,000/year in guaranteed interest.

- Profit Sharing: From resale profits, bondholders gain an additional $150,000/year (assuming 100 homes are resold over 10 years).

- Tax Benefits: Depreciation on modular homes provides significant tax offsets, enhancing after-tax returns.

4. Lease-to-Own Model for First-Home Buyers

- Affordable Payments: Buyers lease modular homes at $1,800/month, ~25% below market rent.

- Pathway to Ownership: Lease payments contribute towards ownership, with buyers able to purchase homes outright after 15–20 years.

- Equity Growth: Buyers retain 80% of resale profits, building wealth while maintaining affordability.

5. Government Support

- First-Loss Guarantee: The state guarantees 10% of the bond value ($3,500,000) to mitigate investor risk.

- Revenue Recovery: Through lease payments and resale shares, the government earns $3,500,000, offsetting land contributions.

How the Numbers Could Work

Project Costs

| Expense | Amount | Notes |

|---|---|---|

| Land (16 hectares) | $20,000,000 | Held by CLT at $1,250,000/ha. |

| Modular Home Construction | $70,000,000 | $350,000 per home for 200 homes. |

| Site Infrastructure | $13,000,000 | Roads, utilities, and drainage. |

| Total | $103,000,000 | Funded by bonds, lease payments, and resales. |

Revenue Sources

| Source | Annual Revenue | Notes |

| Lease Payments | $4,320,000 | $1,800/month × 200 homes. |

| Fixed Yield Payments | -$2,275,000 | Annual interest for 6.5% yield. |

| Profit Sharing (10% Resales) | $150,000 | Assumes 100 homes resold over 10 years. |

| Depreciation Tax Benefits | $1,866,666/year | Enhances bondholder returns. |

Key Benefits to Stakeholders

1. Bondholders

- Attractive Returns: Fixed 6.5% yield plus profit sharing and tax benefits.

- Liquidity: Bonds can be traded on secondary markets through REBS.

- Low Risk: Government-backed first-loss guarantee provides security.

2. First-Home Buyers

- Affordable Entry: Lease-to-own payments ~25% below market rent.

- Equity Growth: Buyers retain 80% of resale profits.

- Ownership Opportunity: A clear pathway to homeownership over 15–20 years.

3. Community Land Trust (CLT)

- Sustainability: Retains 20% of resale profits for reinvestment.

- Affordability: Land remains communal, ensuring long-term affordability.

- Community Benefits: Funds are reinvested in infrastructure, community developments and services.

4. State Government

- Revenue Recovery: Earns $3,500,000 from lease payments and resale shares.

- Social Impact: Provides affordable housing while driving community development.

Why This Model Works

- Balanced Incentives: Aligns investor returns, homeowner affordability, and societal benefits.

- Tax and Liquidity Advantages: Depreciation claims and REBS trading enhance investment appeal.

- Scalability: The model can be replicated across Australia, providing a national framework for affordable housing.

- Social Impact: Long-term affordability and community ownership create a fairer housing market.

The Boomer Bonds Economic Model is not just a financial solution; it’s a method for aligning inter-generational wealth with societal progress. By leveraging innovative financial structures and community-driven values, we can create housing that works for everyone—ensuring a better future for generations to come.

Frequently Asked Questions (FAQs)

1. What are Boomer Bonds?

Boomer Bonds are a financial instrument backed by Boomers' property equity, designed to fund affordable housing through Community Land Trusts (CLTs). They provide secure returns for investors while enabling younger Australians to access affordable home ownership.

2. How do Boomer Bonds benefit Boomers?

Boomers earn a fixed annual yield of 6.5% on their investment, backed by land assets. They also share in resale profits and contribute to creating sustainable, affordable housing communities, leaving a lasting legacy.

3. What is a Community Land Trust (CLT)?

A CLT is a community-driven organisation that holds land in trust to ensure long-term affordability. Homeowners own the dwelling, while the land remains under trust ownership, preventing speculative price increases.

4. How does the lease-to-own model work for home buyers?

Home buyers pay a monthly lease, typically 25% below market rent, toward owning the modular home. After 15–20 years, they own the home outright, retaining 80% of resale profits.

5. Are Boomer Bonds a safe investment?

Yes, Boomer Bonds are secured by land assets held in trust. The state government provides a first-loss guarantee on 10% of the bond value, reducing investment risks.

6. How are the bondholder yields funded?

Bondholder yields are funded through lease payments from home buyers and a share of profits from home resales. This creates a self-sustaining financial ecosystem.

7. What are movable chattel homes?

These are modular homes treated as personal property rather than real estate. They reduce upfront costs for buyers and allow for flexibility in ownership and resale.

8. What role does the government play in the Boomer Bonds model?

The government allocates land to CLTs, provides infrastructure, and offers a first-loss guarantee on bonds. This ensures financial viability and encourages private investment.

9. How does the model benefit communities?

CLTs reinvest 20% of resale profits into community developments and services, enhancing livability and ensuring sustainable growth. Green spaces and eco-friendly homes further improve community quality of life.

10. Is the model scalable across Australia?

Yes, the Boomer Bonds model is designed to be scalable. By replicating the CLT framework and leveraging public land, it can address housing shortages nationwide.

Further Reading